Insurance Risk Modeling Insights for Star Atlas

Insurance Risk Modeling Insights for Star Atlas

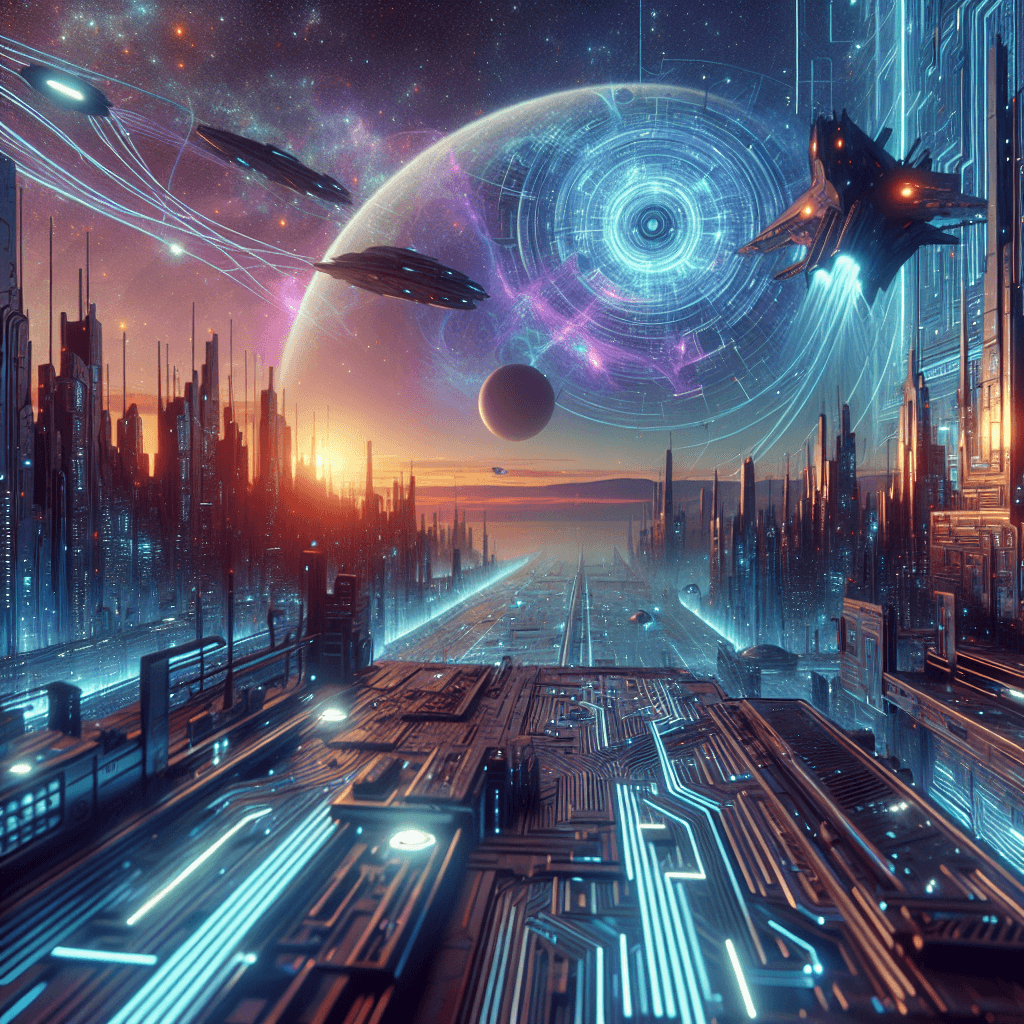

In the fast-evolving universe of Star Atlas, where players explore, build, and engage in a digital frontier, understanding potential risks can be crucial for both gamers and investors. At Titan Analytics, we believe that the principles of insurance risk modeling can provide valuable insights for navigating this thrilling landscape. Let’s break down how these concepts can be applied to Star Atlas in a friendly, approachable way.

What is Insurance Risk Modeling?

Insurance risk modeling is a systematic approach that helps us assess the potential risks associated with various activities and assets. It allows insurers to evaluate the likelihood of certain events occurring, such as accidents, losses, or other unforeseen circumstances. By analyzing historical data and current trends, models can predict future risks and help in making informed decisions.

Applying Insurance Risk Modeling to Star Atlas

-

Asset Valuation:

Just like real-world assets, in Star Atlas, ships, land, and NFT collectibles have their own value. Utilizing risk modeling, players can understand the volatility of their assets. Historical data on asset trades, rarity, and utility can inform predictions on how asset values may change. -

Gameplay Risks:

Engaging in missions, battles, or explorations poses various risks—like losing a ship or failing a mission. By analyzing past gameplay data and outcomes, models can predict average losses and help players develop strategies to minimize risk, much like how insurers evaluate the likelihood of claims. -

Investment Strategies:

For investors in Star Atlas, understanding market trends is key. Risk modeling can help analyze investment portfolios, identifying which assets carry higher risks and potential returns. This insight enables smarter investment decisions, optimizing reward versus risk. -

Community Dynamics:

The behavior and decisions of players in Star Atlas directly impact the ecosystem. Using modeling techniques, we can simulate different scenarios based on player interactions. For example, what happens if a certain faction dominates? Understanding these dynamics helps players and investors to foresee potential shifts in the game’s landscape. -

Scenario Analysis:

Insurance risk models often employ scenario analysis, where different potential futures are evaluated for their impact. In Star Atlas, players can benefit from similar assessments—considering “what if” situations like major game updates or shifts in player behavior.

Conclusion

By adopting the principles of insurance risk modeling, both players and investors in Star Atlas can enhance their understanding of risks and make more informed decisions. It’s all about leveraging data to anticipate and navigate the ever-changing universe of Star Atlas.

If you’re interested in diving deeper into the data that can help optimize your Star Atlas experience, check out Titan Analytics’ data modules at titananalytics.io/modules/ or reach out to us at titananalytics.io/contact/. Happy exploring!